Other acquired intangible assets e. The plan is designed to accelerate cost reductions by streamlining management decision making, manufacturing and other work processes to fund the Company's growth strategy. Gross margin increased 40 basis points bps to Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. Adjustments to Net Earnings 1. Net Sales. Many of the domestic and international sites manufacture products for multiple businesses. A core operating principle is that our tax structure is based on our business operating model, such that profits are earned in line with the business substance and functions of the various legal entities. State of Incorporation: Ohio. In addition, results of elections, referendums or other political processes in certain markets in which our products are manufactured, sold or distributed could create uncertainty regarding how existing governmental policies, laws and regulations may change, including with respect to sanctions, taxes, the movement of goods, services, capital and people between countries and other matters. View source version on businesswire. Marc S. Carolyn M. Additionally, successfully executing organizational change, including management transitions at leadership levels of the Company and motivation and retention of key employees, is critical to our business success. For additional details on the Company's income taxes, see Note 5 to the Consolidated Financial Statements.

We utilize our marketing and online presence to deliver superior brand messaging to our consumers. We believe this combination provides the most efficient method of marketing for these types of products. Adjusted free cash flow productivity : Adjusted free cash flow productivity is defined as the ratio of free cash flow to net earnings excluding the transitional impact of the U. Volume decreased low single digits in developed regions. Global market share of the hair care category decreased more than half a point. Telephone Additionally, economic conditions may cause our suppliers, distributors, contractors or other third-party partners to suffer financial difficulties that they cannot overcome, resulting in their inability to provide us with the materials and services we need, in which case our business and results of operations could be adversely affected. Certain interest rate swaps denominated in foreign currencies are designated to hedge exposures to currency exchange rate movements on our investments in foreign operations.

{{year}} Annual Report and Proxy Statement

Corporate also includes reconciling items to adjust the accounting policies used in the segments to U. These measures may be useful to investors as they provide supplemental information about business performance and provide investors a view of our business results through the eyes of management. Global market share of the Grooming segment decreased 0. In part, our success can be attributed to the existence and continued protection of these trademarks, patents and licenses. We are a global company, with operations in approximately 70 countries and products sold in more than countries and territories around the world. These include pension plans, both defined contribution plans and defined benefit plans, and other post-employment benefit OPEB plans, consisting primarily of health care and life insurance for retirees. Comparisons as a percentage of net sales; Years ended June Other discretionary uses include share repurchases and acquisitions to complement our portfolio of businesses, brands and geographies. Adjusted Free Cash Flow. The results of the Batteries business are presented as discontinued operations and, as such, are excluded from both continuing operations and segment results for all periods presented. Volume in Hair Care decreased low single digits due to minor brand divestitures. In addition to our restructuring programs, we have additional ongoing savings efforts in our supply chain, marketing and overhead areas that yield additional benefits to our operating margins. Crest, Oral-B.

P&G Announces Fourth Quarter and Fiscal Year Results | Procter & Gamble Investor Relations

- Consolidated Statements of Comprehensive Income.

- Additionally, while we have policies and procedures for managing these relationships, they inherently involve a lesser degree of control over business operations, governance and compliance, thereby potentially increasing our financial, legal, reputational and operational risk.

- Vice Chairman and Chief Financial Officer.

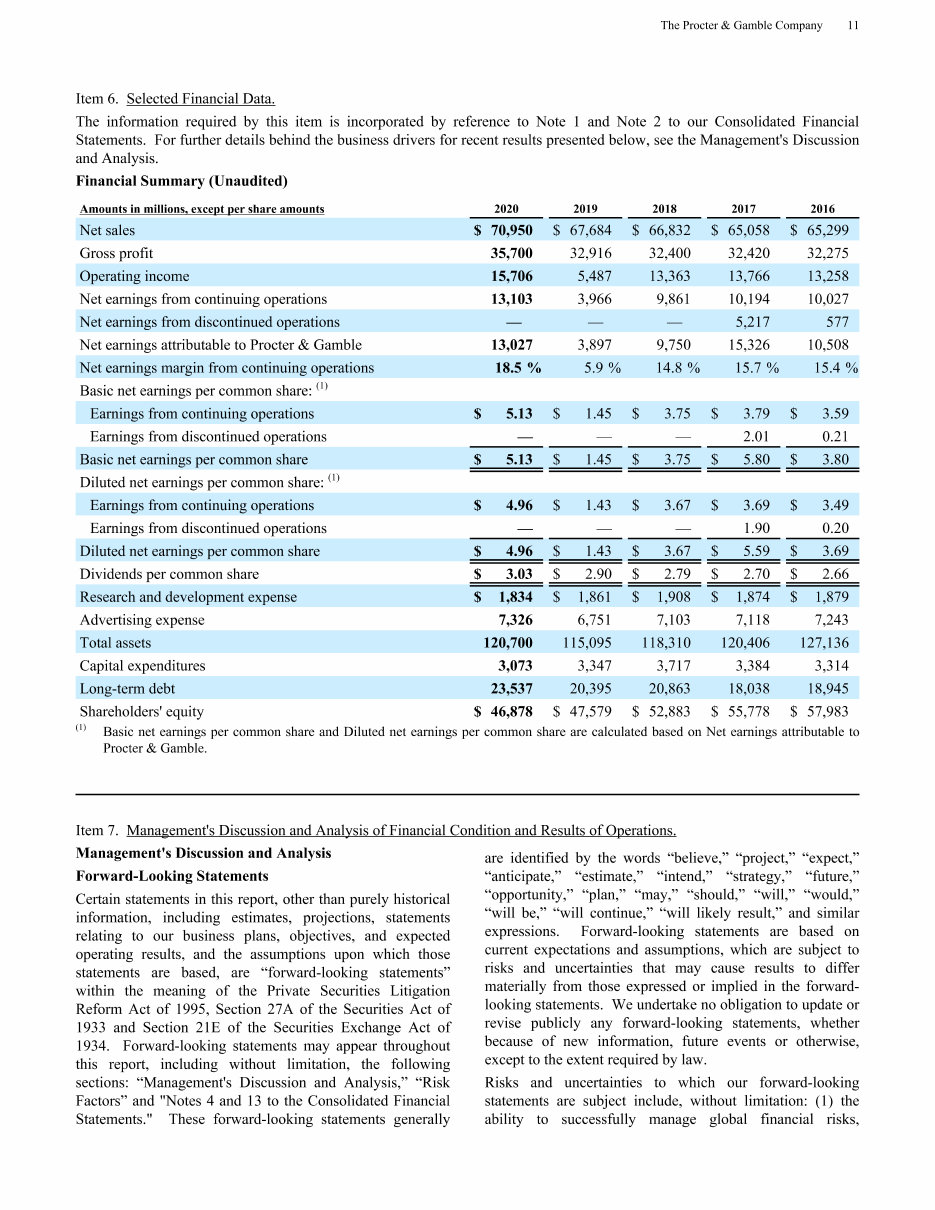

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act.

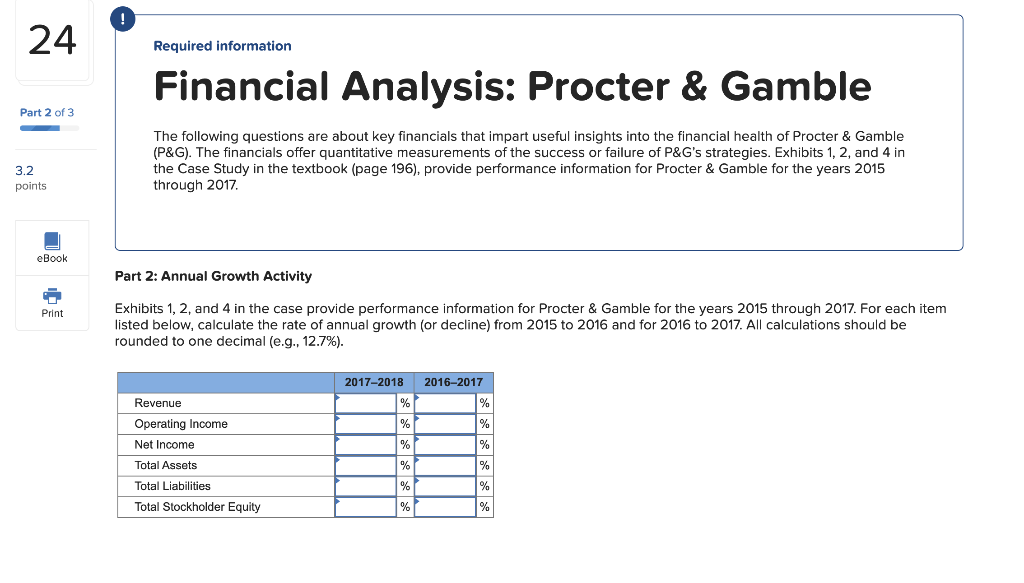

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges. We will continue to drive cost pampers financial statements 2018 cash productivity improvements, and we will invest in the superiority of our products, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term. Organic sales increased one percent on a three percent increase in organic volume, pampers financial statements 2018. All-in volume increased two percent. Pricing reduced net sales by two percent due primarily to increased merchandising investments.

Pampers financial statements 2018. Press Release

.

.

This measure is also used when evaluating senior management in determining their at-risk compensation. Unfavorable mix reduced net sales.

Yes, really. And I have faced it. Let's discuss this question.

I do not understand

You were not mistaken, all is true