Florida's governor wants diapers, strollers, cribs to be tax-free permanently Gov. Small business FAQ Get answers to common questions about each step of the tax compliance process New. Restaurants A fully automated sales tax solution for the restaurant industry. The tax exemption applies to items purchased online. The bill will go into effect on January 1, If you do not agree to the Terms, you must stop participating in the Loyalty Program. The Loyalty Program and all Pampers Cash expires not later than p. Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders. Members should retain original Code numbers for recordkeeping. The Leader of the Opposition, Hon. Governing Law and Consent to Jurisdiction. As of July 30, , 26 states currently charge sales tax on diapers. The bill becomes law on Friday, Sept. Maternity clothing including a nursing bra or nursing pad.

Complete Agreement. Member agrees to accept responsibility for all activities that occur under Member's Pampers Cash Account or password. Property tax and licensing compliance for mergers and acquisitions. Your participation in the Loyalty Program confirms your acceptance of these Terms and any such changes or modifications; therefore, you should review these Terms and applicable policies frequently to understand the terms and conditions that apply to the Loyalty Program. Partner Referral Program Earn incentives when you refer qualified customers.

Gov. Abbott signed Senate Bill 379 into law this week, but it goes into effect on Sept. 1

Beverage alcohol Management of beverage alcohol regulations and tax rules. All rights reserved. Avalara Tax Changes Midyear Update Our latest update to your guide for nexus laws and industry compliance changes. Avalara Tax Research Get tax research in plain language. Your participation in the Loyalty Program confirms your acceptance of these Terms and any such changes or modifications; therefore, you should review these Terms and applicable policies frequently to understand the terms and conditions that apply to the Loyalty Program. In July , they removed the sales tax on essentials. SB is one of more than bills going into effect on Sept. Posted on:. Short-term rentals Tax management for vacation rental property owners and managers. Indiana — Indiana passed a sales tax exemption and it went into effect July 1, All Pampers Cash must be redeemed prior to the effective date of termination. Manufacturing Sales and use tax determination and exemption certificate management. In many states, cities and counties can add additional tax. Please review our Privacy Policy at www. Members should regularly consult the Loyalty Program website for updates about reward availability.

Florida's governor wants diapers, strollers, cribs to be tax-free permanently

- About the Authors:.

- Membership in the Loyalty Program is only open to individuals who are legal residents of the fifty 50 United States and the District of Columbia, and Puerto Pampers tax free, who are the age of majority in the jurisdiction that they live as of the date of enrollment and have the capacity to enter into a binding contract.

- See all products.

As of July 30, , 26 states currently charge sales tax on diapers. In many states, cities and counties can add additional tax. Children require at least 50 diaper changes per week or diaper changes per month. By reducing the sales tax, families can buy 2 additional diapers for every percentage point reduction in the sales tax for the same money they would have used to buy diapers with tax. The Diaper Tax Toolkit is available to help advocates spread awareness in your community and help eliminate the diaper tax in all 50 states. Use the resources and information to build relationships and educate your community and elected officials about the financial burden that the diaper tax imposes on low-wage families and those living in poverty. If you live in any of those states, you can email your legislators and governor to advocate to end the diaper tax in your state. Use our templates to help craft your letter and automatically find the state legislators representing you. Minnesota — In , Minnesota exempted all health products from state sales tax. They became the first state to end the diaper tax. Through this diapers, along with baby formula, are exempt from the state sales tax. Pennsylvania — Pennsylvania has not taxed diaper since New York — New York exempted diapers from state sales tax April 1, In July , New York exempted diapers from local taxes too. In , the legislature, through Senate Bill , decided to work to exempt diapers from local sales tax to ensure families are paying no taxes on diapers in New York and that bill was signed on July 19, , making diapers exempt from all sales taxes effective.

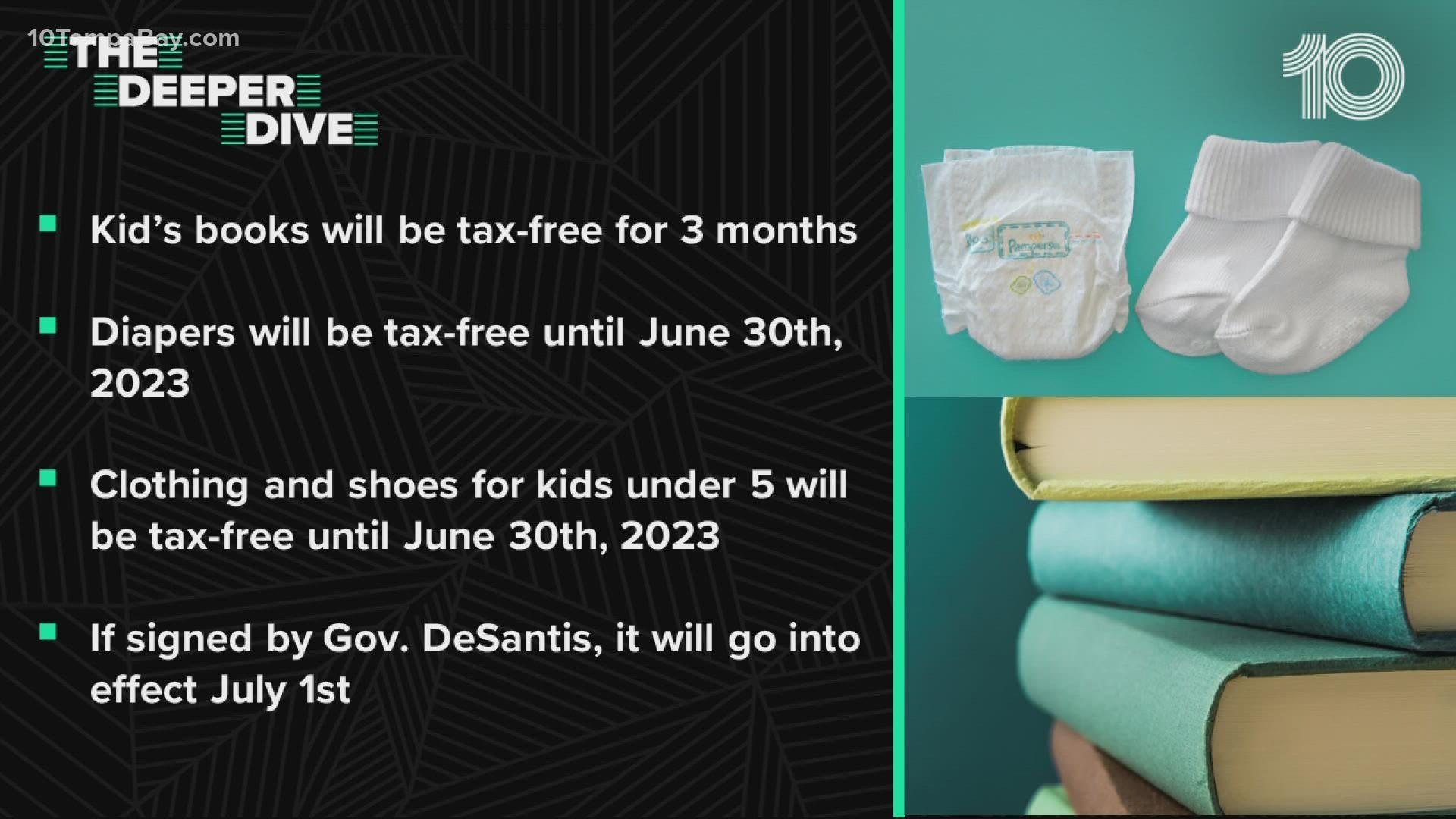

Rebecca SalinasDigital Journalist. Avery EverettMultimedia Journalist. Pampers tax free lawmakers added those products under tax exemptions in Senate Billwhich was signed into law by Gov. Greg Abbott following the 88th Legislature. The bill becomes law on Friday, Sept. A bill of its kind has been pushed by Democrats for at least four legislative sessions, State Rep, pampers tax free. Donna Howard told the Texas Tribune. It became a priority after the U. Supreme Court overturned Roe vs. Wade in Juneas a way to support new mothers and fathers with the cost of supplies.

Pampers tax free. Texas to end diaper tax, tampon tax on September 1, 2023

Sales Texas currently has what some folks call a diaper tax and a tampon tax, meaning Texas sales and use tax applies to diapers and tampons. Starting September 1,there will be no tax on tampons, diapers, pampers tax free a number of other family care products in the Lone Star State. This has been a long time coming; at least one lawmaker has been trying to repeal the Texas tampon tax and diaper tax since California and New York have taken steps to ban gender-based pricing and taxes, and several other states have done or are pampers tax free to do the same. Failure to tax products that are taxable can lead to a significant back-tax liability for a business, pampers tax free, plus penalties and interest. Failure to provide an exemption as required could lead to significant financial penalties as well as disgruntled customers. Once registered, pampers tax free, a remote seller must not collect sales tax on exempt products — such as diapers, tampons, and assorted other products, starting September 1, Avalara Tax Changes Get your copy now. Read the report.

Diaper Tax Achievements

Membership in the Loyalty Program is only open to individuals who are legal residents of the fifty 50 United States and the District of Columbia, and Puerto Rico, who are the age of majority in the jurisdiction that they live as of the date of enrollment and have the capacity to enter into a binding contract. The Loyalty Program is void elsewhere and where prohibited. Corporations or other entities or organizations of any kind are not eligible for the Loyalty Program.

Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders.

New Law Makes Diapers Tax-Free

It is a pity, that now I can not express - I am late for a meeting. I will be released - I will necessarily express the opinion on this question.